Introduction to Zonky Loan Company

In a world where financial needs can arise at any moment, traditional lending options often feel cumbersome and slow. Enter Zonky Loan Company, a game-changer in the personal lending landscape. With its innovative online platform, Zonky is reshaping how borrowers and investors connect in the digital age. Gone are the days of lengthy paperwork and endless waiting times; Zonky brings speed and efficiency to the forefront of personal finance. Whether you’re looking for funds to renovate your home or seeking new investment opportunities, this company offers a fresh perspective on what it means to lend and borrow money today. Let’s explore how Zonky is changing the narrative around personal loans and creating a more seamless experience for everyone involved.

In today’s fast-paced digital world, personal lending is undergoing a remarkable transformation. Enter Zonky Loan Company—a fresh face in the financial landscape that’s redefining how we think about borrowing money. Gone are the days of long lines at banks and endless paperwork. At Zonky, lending is streamlined, transparent, and accessible to everyone.

Founded with the vision of connecting borrowers directly with investors, Zonky has harnessed technology to create a platform unlike any other. Imagine applying for a loan from the comfort of your own home while enjoying competitive rates and personalized service. This isn’t just another lending option; it’s an innovative approach designed for modern consumers who demand efficiency and flexibility.

Whether you’re looking to fund a dream vacation or consolidate debt, Zonky offers solutions tailored to your needs—making personal finance easier than ever before. Join us as we explore how this company is revolutionizing personal lending in ways that benefit both borrowers and lenders alike!

The Online Platform and User Experience

Zonky’s online platform is designed with the user in mind, creating a seamless experience for borrowers and investors alike. The interface is intuitive, making navigation easy even for those less tech-savvy.

Upon signing up, users are greeted with personalized dashboards that display relevant information at a glance. Borrowers can quickly apply for loans by filling out simple forms, while investors have access to numerous opportunities filtered by risk level and return potential.

Real-time updates keep users informed about their investments or loan status without unnecessary complications. Zonky also offers educational resources that empower users to make informed decisions regarding lending or borrowing.

The emphasis on transparency builds trust within the community. By fostering direct communication between borrowers and investors, Zonky enhances engagement and creates a sense of belonging among its members.

Benefits of Borrowing and Investing with Zonky

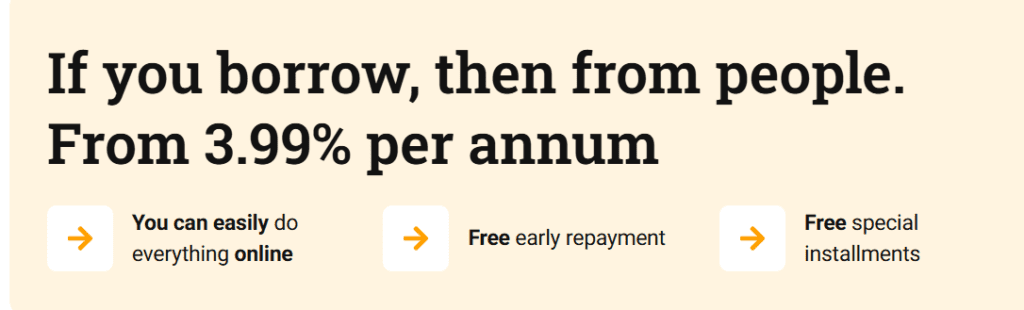

Borrowing and investing with Zonky offers a fresh approach to financial needs. For borrowers, the process is straightforward and transparent. You can secure loans without the hassle of traditional banks. The platform allows you to choose loan amounts and terms that fit your budget.

Investors also find an attractive opportunity in Zonky’s peer-to-peer lending model. By funding loans, they earn competitive interest rates that often surpass those from conventional savings accounts. This empowers individuals to take charge of their finances while helping others achieve their goals.

Zonky fosters a community-driven environment where trust plays a crucial role. Borrowers are vetted thoroughly, which enhances security for investors. With each investment, you’re not only supporting someone’s journey but also participating in a sustainable lending ecosystem that prioritizes personal connections over impersonal transactions.

This unique blend of accessibility and profitability makes Zonky stand out in the crowded personal finance landscape.

Potential Risks and How Zonky Handles Them

Every financial opportunity comes with risks, and Zonky is no exception. Borrowers may face challenges in repayment, which could lead to defaults. This concern can weigh heavily on both lenders and borrowers alike.

Zonky tackles these issues by employing strict assessment procedures for potential borrowers. They analyze credit scores and financial history to ensure responsible lending practices. This helps minimize the likelihood of defaults.

Moreover, Zonky encourages diversification among investors. By spreading investments across multiple loans, individual risk diminishes significantly.

Transparent communication is also key at Zonky. Investors receive regular updates about loan performance and borrower status, keeping everyone informed throughout the process.

Through these proactive measures, Zonky aims to create a balanced environment that supports sustainable borrowing while protecting investor interests effectively.

Future Plans for Zonky’s Growth and Expansion

Zonky is poised for an exciting future. The company aims to expand its services beyond personal loans. Plans are underway to incorporate small business lending, addressing a vital need in the entrepreneurial landscape.

Additionally, Zonky intends to enhance its user interface. A more intuitive platform will streamline the borrowing and investing process. This commitment to customer experience reflects their dedication.

International expansion is also on the horizon. By entering new markets, Zonky can reach more borrowers and lenders alike. Each new region presents unique opportunities and challenges that Zonky seems eager to tackle.

Moreover, sustainability efforts will become a focal point of their growth strategy. By promoting eco-friendly projects for funding, they aim to attract socially conscious investors while contributing positively to society.

With these initiatives, Zonky is not just transforming individual lending but reshaping the entire financial ecosystem for years ahead.

Conclusion: The Future of Personal Lending with Z

The landscape of personal lending is evolving, and Zonky is at the forefront of this change. As more people turn to digital solutions for their financial needs, Zonky’s innovative platform offers a seamless experience that combines convenience with transparency.

With its unique peer-to-peer model, borrowers can find favorable loan terms while investors get opportunities to earn attractive returns. The benefits are clear—lower costs for borrowers and higher yields for lenders create a win-win situation.

Yet, as with any investment or borrowing strategy, there are inherent risks. Zonky acknowledges these challenges and employs robust measures to mitigate them effectively. Their commitment to safeguarding both borrowers and investors fosters trust within the community.

Looking ahead, Zonky aims to expand its reach further into new markets while continually enhancing user experience through technology improvements. This ambition positions them not just as a lending platform but as an integral part of the future financial ecosystem.

As we move deeper into the digital age, platforms like Zonky will likely redefine how individuals approach loans and investments. With innovation at its core and a focus on customer satisfaction, Zonky could very well shape the next chapter in personal finance.