Introduction to Zonky Loans

In today’s fast-paced financial landscape, finding the right loan can feel overwhelming. Traditional banks often have rigid criteria and lengthy processes that leave borrowers frustrated. Enter Zonky Loans—a fresh alternative shaking up the lending scene. This innovative platform connects borrowers with individual lenders in a way that feels personal and empowering. No more impersonal dealings; it’s about real people helping each other out.

Imagine being able to secure flexible financing while also having the opportunity to earn interest on your savings by supporting others in need. With Zonky Loans, this vision becomes a reality. Let’s dive into how it works and why it might just be the solution you’ve been searching for!

Have you ever thought about how borrowing and lending could be made easier? Enter Zonky Loans, a platform that is shaking up the traditional finance world. Say goodbye to long queues at banks and tedious paperwork. With Zonky, borrowers and lenders come together in a fresh, innovative way.

Imagine being able to secure a loan while connecting with individuals who want to invest their money wisely. This unique setup not only benefits those seeking financial support but also opens doors for everyday people looking to grow their savings. Ready to dive into how this dynamic model works? Let’s explore the ins and outs of Zonky Loans!

How Zonky Loans Connects Borrowers and Lenders

Zonky Loans operates as a peer-to-peer lending platform, bridging the gap between those who need funds and individuals looking to invest their money. The process is straightforward and user-friendly.

Borrowers create profiles detailing their financial needs and creditworthiness. This transparency helps potential lenders assess risk easily.

Once applications are submitted, they become visible to lenders who can browse various loan requests. Lenders have the power to choose which borrowers they’d like to support based on personal criteria.

The platform encourages direct communication between parties, allowing them to discuss terms openly. This human touch sets Zonky apart from traditional banks.

Additionally, Zonky employs technology that streamlines transactions while ensuring security in every step of the process. By leveraging data analytics, it matches suitable lenders with borrowers efficiently.

The Benefits of Using Zonky Loans for Borrowers

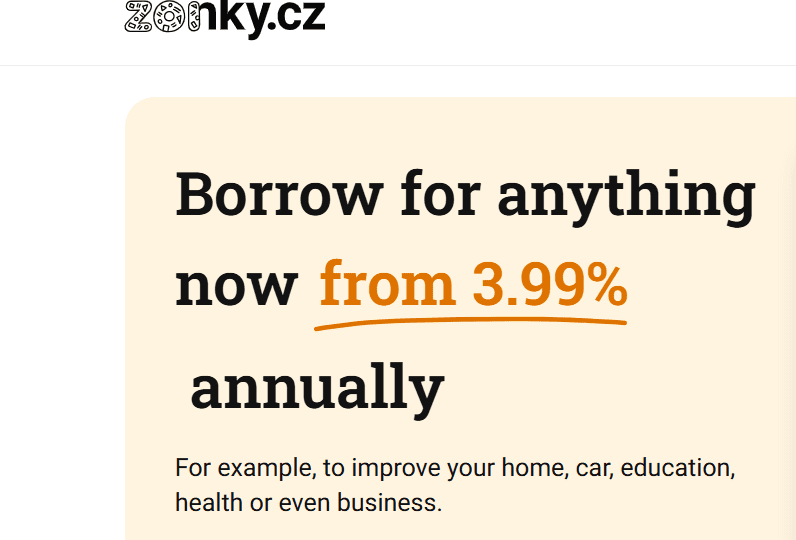

Zonky Loans offer a fresh approach for borrowers seeking financial assistance. One of the standout features is the competitive interest rates. Thanks to its peer-to-peer lending model, many borrowers find more favorable terms compared to traditional banks.

Flexibility is another significant advantage. Borrowers can choose loan amounts and repayment periods that suit their individual needs, making it easier to manage finances without unnecessary stress.

Moreover, Zonky emphasizes transparency throughout the borrowing process. Users have access to clear information on fees and conditions before committing, which builds trust between all parties involved.

The platform fosters a sense of community. Borrowers can connect directly with lenders who are often motivated by personal stories rather than just profit margins. This connection adds a layer of support and encouragement during what can be a daunting experience for many individuals seeking loans.

The Benefits of Using Zonky Loans for Lenders

Lenders looking for a new way to invest will find Zonky Loans appealing. The platform offers an opportunity to earn competitive interest rates on funds.

Investing in loans can diversify portfolios, reducing overall risk. Lenders choose specific borrowers based on personal preferences and risk assessments. This level of control is rare in traditional banking.

Zonky also provides transparency throughout the lending process. Investors can track their loans and see how repayments are progressing in real-time.

Moreover, supporting individuals seeking financial help adds a rewarding aspect to lending. Joining this community fosters a sense of connection between lenders and borrowers, transforming what could be a cold transaction into something more meaningful.

With flexible investment amounts ranging from small sums to larger contributions, Zonky makes it easy for anyone to get involved without needing extensive capital.

Success Stories from Zonky Loan Users

Zonky has transformed the lives of many borrowers and lenders alike. Take Anna, for example. After struggling to finance her small business, she turned to Zonky. With a tailored loan from individual lenders who believed in her vision, she was able to launch her café successfully.

Then there’s Tom. He wanted to consolidate his debts but faced rejection from traditional banks. Zonky’s platform allowed him to connect with compassionate lenders willing to support his journey toward financial recovery.

Even seasoned investors have found success on Zonky. Maria, an experienced lender, discovered a way to diversify her portfolio while helping others achieve their dreams.

These stories highlight not just financial transactions but genuine connections formed through shared goals and trust within the community. The impact goes beyond numbers; it fosters hope and empowerment for all users involved in this unique lending ecosystem.

Conclusion

Zonky Loans offers a refreshing perspective on personal finance by bridging the gap between those who need funds and those who can provide them. This unique platform promotes transparency, connection, and mutual benefit for both borrowers and lenders.

For borrowers, Zonky provides an opportunity to access loans with competitive rates tailored to their financial situations. It fosters a sense of community where individuals feel empowered to take control of their financial journeys.

On the other side, lenders enjoy the satisfaction of supporting others while earning attractive returns on their investments. The ability to choose which projects or individuals they want to support adds a personalized touch that traditional banking cannot match.

The success stories from real users highlight just how impactful Zonky can be in transforming lives through accessible funding options. Each story is a testament to what this innovative model achieves—real change facilitated by everyday people.

As more individuals discover the benefits of peer-to-peer lending through platforms like Zonky, it’s clear that this approach could redefine how we think about loans today. Whether you’re looking for assistance or eager to help someone achieve their dreams, Zonky creates opportunities worth exploring further.